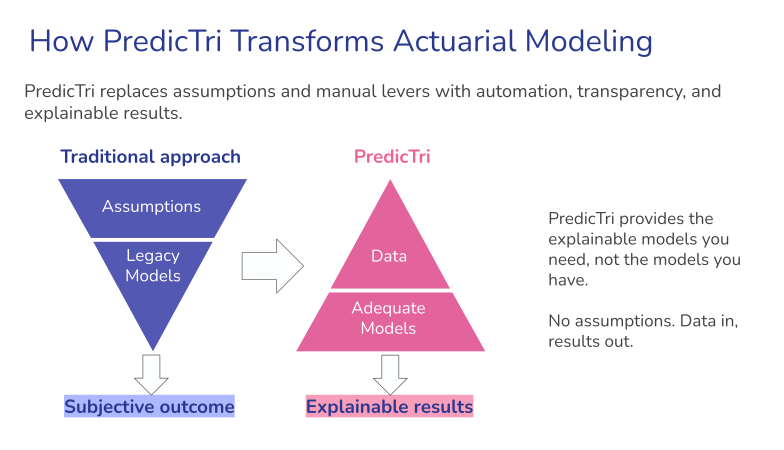

💡 Why PredicTri?

PredicTri is a cloud-based actuarial tool that brings Bayesian machine learning to triangle reserving.

In simple terms: we help insurers predict future claims costs more accurately and transparently, helping manage risk and allocate capital more effectively.

Designed for actuaries, PredicTri adds a second layer of insight and validation to your existing workflow, improving accuracy and explainability where it matters most.

Market Endorsements

- Head of Operations, global insurer: "Exactly what should be replacing the old process."

- Chief actuary: "Something new, unlike anything that exists today... Reserve estimate feeds directly into the financial statements."

- Data science: "Checking if the percentiles follow a uniform distribution is a great way to validate estimates."

- Consulting (Global): "We want the 95th percentile, not just expected value."

- Consulting (Middle East & EU): "Strong client demand for a quick, explainable solution that mirrors familiar results while modernizing reserving practice"

- Regulatory validation: "The model provides full predictive distributions that support date-driven oversight... It also brings transparency... I`d like to see proof through cases where the actuary and model disagree."

Accurate Results

In Bayesian methodology, each model is validated based on its ability to predict unseen data, rather than merely its fit to historical observations.

Model Validation & Selection

PredicTri evaluates multiple models and automatically selects the best-performing one based on predictive power.

Second Opinion / Peer Review

Use PredicTri as a second-opinion tool to review traditional results.

Transparent Outputs

Transparent outputs with confidence intervals and model diagnostics. No black box models.

Regulatory Ready

Designed for accuracy, explainability and regulatory support with full documentation.

Small Portfolio Compatible

Compatible with small or volatile portfolios where traditional methods struggle.

Workflow Enhancement

Enhances your existing workflow without replacing your models or professional judgment.

Joint Modeling

Joint modeling of paid and incurred triangles for comprehensive analysis and improved accuracy.

One-Pager

A concise overview of what PredicTri does and why it matters for actuaries. ➡️ Download the One-Pager

Methodology & Case Study

See how PredicTri’s explainable Bayesian approach works. And what it revealed in a real portfolio. ➡️ Download the study

Input & Output Instructions

Simple guidance on how to upload your triangle and understand the results. ➡️ View Input/Output Instructions

Video Walkthrough

A quick demo showing how to use PredicTri. ➡️ Watch on YouTube

Content Library

Comprehensive collection of articles, case studies, and insights on AI/ML in actuarial practice. ➡️ Browse Content Library

🚀 Want to Try PredicTri?

Get in touch with our team to request a trial and see how PredicTri can improve your actuarial workflow.

💬 Join the Discussion

We're building a community of actuaries shaping the future of reserving. Connect with fellow professionals, share insights, and discuss the latest developments in AI/ML applications for actuarial science.

Join LinkedIn GroupPredicTri is a software tool for non-life insurance reserving. It takes the same input data actuaries already use, paid and incurred claims triangles, and applies advanced Bayesian machine learning. The approach captures uncertainty, structural changes, and correlations that standard deterministic or stochastic triangle methods often miss. PredicTri provides actuaries with an explainable second opinion that can be directly compared with existing calculations, helping them validate assumptions and clearly explain results.

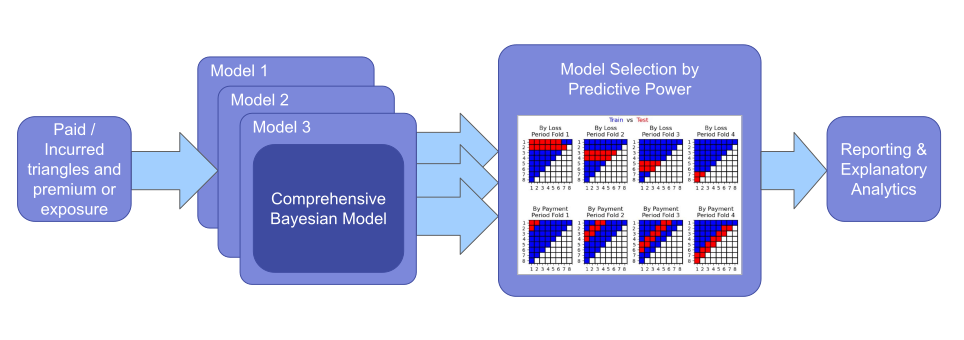

How It Works:

Modelling Flow

- PredicTri starts with the input data: paid and/or incurred claims triangles together with premium or other exposure measures.

- Next, PredicTri runs the data through multiple Bayesian models.

- Each model is tested for how well it predicts unseen parts of the data, using a cross-validation method.

- The system selects the model with the strongest predictive power.

- Finally, the results are presented through clear reports and analytics that explain both the numbers and the drivers behind them.

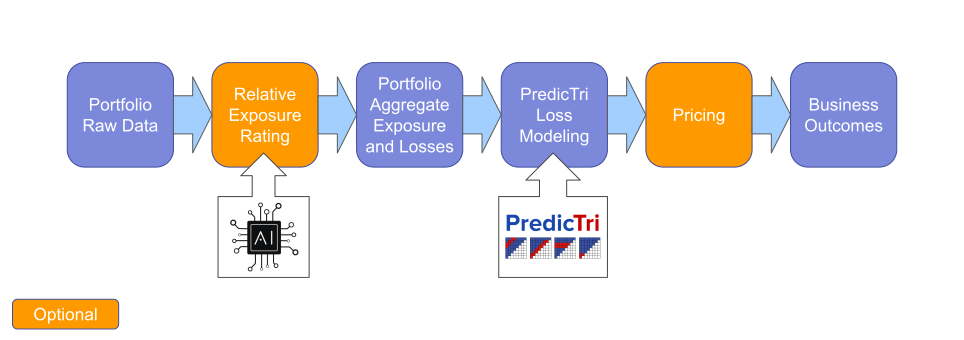

Business Flow

PredicTri links technical reserving with business outcomes. You begin with your usual risk segmentation and exposure build-up, then model aggregate losses with PredicTri. This produces transparent reserves and capital requirements. Once the capital picture is clear, you can overlay pricing to evaluate profitability and strategic outcomes.

- Define risk groups or exposure categories; some initial modeling can already be applied at this stage.

- Build portfolio aggregates.

- Model aggregate losses with PredicTri.

- Assess reserves and capital requirements.

- Overlay pricing to understand business outcomes.

Key Benefits:

- Enhanced accuracy through Bayesian machine learning

- Full transparency with confidence intervals and diagnostics

- Regulatory compliance and explainable results

- Seamless integration with existing workflows

- Designed specifically for actuarial professionals

Yulia Yulish-Nechay

Co-Founder | ActuaryYulia is a fully qualified actuary with over 16 years of experience in non-life insurance, spanning reserving, pricing, reinsurance, and portfolio risk management.

At PredicTri, she leads the actuarial methodology, model validation, and explainability framework, ensuring results are transparent, comparable to traditional approaches, and suitable for regulatory review.

She is actively involved in international actuarial work on AI adoption and leads the professional LinkedIn community Next-Gen Triangle Modeling with AI/ML.

Ben Zickel

Co-Founder | CTOBen is a physicist and algorithm developer with more than 25 years of experience in signal processing, machine learning, stochastic modeling, and high-performance computing.

At PredicTri, he leads the Bayesian modeling framework, including probabilistic model design, predictive model validation, and development of robust inference methods.

His work focuses on translating advanced statistical and computational methods into practical, scalable tools for actuarial decision-making.